Fixed income yields retraced more of this month’s overextended climb, despite few signs of easing inflation, while strong gains for large-cap tech stocks drove equities higher on Wall Street. Central banks were active, but the market toned down the most aggressive rate hiking assumptions for the Fed.

Ahead of yesterday’s European session, the Reserve Bank of New Zealand surprised most analysts with a 50-basis point increase in its overnight cash rate to 1.5%– the first increase of that size since 2000. The Bank of Canada followed suit later in the day with its own 50 basis point hike to 1%, while BoJ Governor Kuroda took the opposite approach, saying he will continue “powerful easing persistently”, propelling the dollar/yen exchange rate to a new 20-year high above $126/¥.

Inflation in the UK hit a thirty-year high in March as surging fuel costs pushed the headline CPI increase to 7% year over year, three tenths above expectations. More concerning, the core rate excluding fuel and food accelerated from 5.2% to 5.7% - four tenths above estimates - with price increases broadening across both goods and services. Clothing and footwear prices were up 9.8% year over year and furniture and household goods were up 10.3%, while hotel rates and the cost of dining out increased by the most in a month since records began in 1988.

The Bank of England spent most of last year asleep at the wheel, worrying about how to implement negative rates rather than acknowledging the surge in economic growth and dialling back stimulus. This latest inflation report for March was the last before the MPC’s May meeting but economists now expect April’s CPI inflation to reach 9%. Governor Bailey’s inept management leaves the bank facing an uncomfortable decision to tighten policy during a “cost of living crisis”, with inflation yet to peak.

Outspoken St Louis Fed Governor James Bullard gave in interview with the FT, warning it is “fantasy” to expect US inflation to decline to target without lifting rates to a level that constrains the economy. Marking his ground as the chief hawk, he said that policy should be tightened “sharply” after the May FOMC meeting, with a total increase of 3 percentage points by the third quarter.

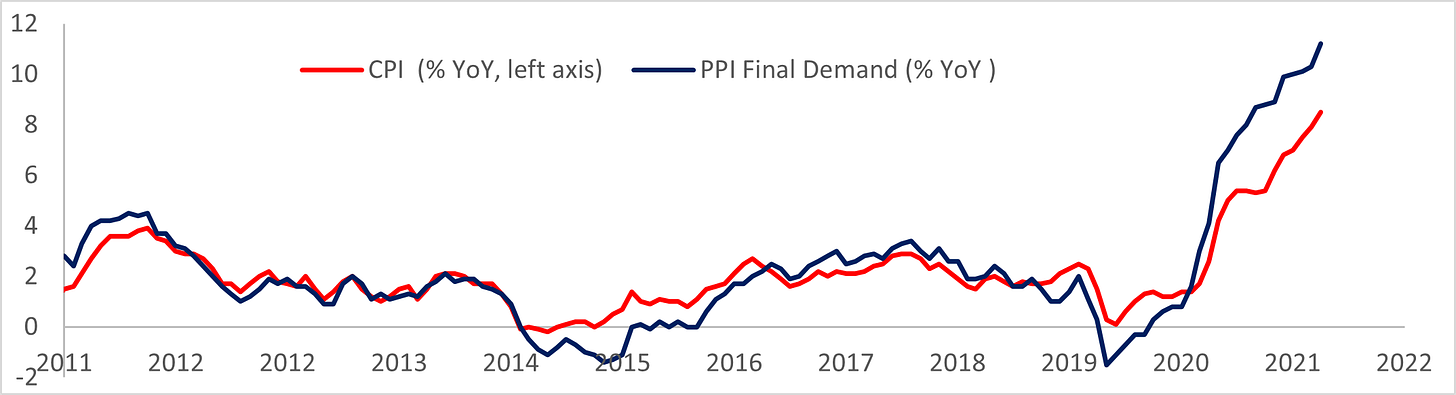

US headline CPI inflation may have peaked, but pipeline pressures remain, with yesterday’s March PPI showing a 1.4% increase on the month – three tenths above estimates while the core rate excluding food and energy rose 1% - twice the amount estimated. Over the year, final demand prices increased 11.2%, the largest increase since 12-month data were first calculated in 2010. PPI covers wholesale goods and services, and while goods prices were up 15.7% year over year or 10% excluding food and energy, services prices also rose 8.7% on the year. Consumer price inflation is unlikely to decline much with such intense price pressures for inputs, although margins may come under pressure.

The average US 30-year mortgage rate broke through 5% last week to 5.13% and applications for refinancing fell a further -4.9% after plunging almost -40% over the prior three weeks. Purchase applications rose 1.4% on the week, but with the mortgage rate almost two percentage points above the rate this time last year and average home prices roughly 19% higher, financing costs for a new home are becoming increasingly stretched.

Commodity prices were mixed with crude prices initially paring gains after the EIA reported a larger than expected inventory build in its weekly report but rallied again into the close. Brent crude futures closed at $108.78/brl (+4%) and WTI at $104.25/brl (+3.6%) while gold fixed at $1,979/oz (+.2%) and silver at $25.73/oz (+.6%). According to the FT, LME warehouse stocks of aluminium, copper, nickel and zinc have plunged 70% over the past year, as supplies are further constrained by rising energy prices, with zinc hitting a 16-year high of $4,525/ton yesterday (+2.5%).

US fixed income rallied strongly again, with the market removing more than 20 basis points from the expected total increase in Fed funds since Monday and taking the two-year treasury yield down another -5.7 bps yesterday to 2.35%. The ten-year closed at 2.7% (-2.3 bps) and the earlier gains for dollar/yen faded, leaving the London fix at 1.2562 (+.2%). In Europe, the two-year bund yield remained positive at .07% (- .1bps) and the ten-year closed at .77% (-2.4 bps), with today’s ECB press conference likely to provide insights into the future pace of tightening. Despite lower yields across the G7, gilt yields barely declined after the higher-than-expected inflation readings, with the ten-year closing at 1.8% (-.4bps).

Equities rebounded on Wall Street despite disappointment with JP Morgan’s earnings which marked the start of the 1st quarter reporting season, with the S&P closing at 4430.63 (+.8%) and the Nasdaq at 13566.94 (+1.5%). Trading revenues in JP Morgan’s fixed income division were a multiple of estimates and equity trading also beat, but a -28% decline in investment banking revenue was worse than expected and left the shares -3.2% lower, weighing on the Financials group (-.1%). Energy (+1.4%) outperformed again while Consumer Discretionary (+2.5%) and Tech (+1.6%) which currently seem the most rate-sensitive also performed well.

European equities continued this week’s slide with the EuroStoxx50 closing at 3827.96 (-.1%). Telecoms (+1.2%) led the sectors thanks to a 3% gain for Telecom Italia on reports of private equity interest in its ConsumerCo business, while Basic Resources (+1.1%) and Energy (+1%) extended gains from the previous day. The FTSE-100 managed to inch ahead to 7580.8 (+.1%) with its mining and energy companies offsetting declines elsewhere. The UK’s largest supermarket, Tesco (-2%) warned of a profit squeeze as it battles to keep its retail prices competitive in the face of escalating food, transportation and labour costs.

Attention today will focus on the statement following the ECB Governing Council meeting and the press conference at 1:30 p.m. London time. US data releases include retail sales for March and the weekly initial and continuing jobless claims. There are also further quarterly reports due ahead of the open from the large banks including Wells Fargo, Morgan Stanley, Goldman and Citigroup.