MacroScope

Markets were little changed ahead of the FOMC announcements, but same-day option pricing reflected the uncertainty of the likely reaction to the statement and press conference. In the event, the Fed downshifted to a 50bps hike- as expected - in a unanimous decision, but the statement had a hawkish tone, and an earlier US equity rally was erased.

Fed to stay higher for longer

The new fed funds target rate of 4.25% to 4.5% matched expectations and the statement was little changed, with the same reference to the need for “ongoing” rate hikes to reach a “sufficiently restrictive” policy stance that returns inflation to the target, but there was a decidedly hawkish tint to the Summary of Economic Projections (SEP) and the DOT plot. The median projected Fed funds rate at the end of 2023 was revised from 4.6% to 5.1%, with seven officials projecting a rate above 5.1%, 10 at 5.1% and two at 4.9%. The SEP update revealed a lower expected growth profile and higher unemployment, with a higher projection for the fed funds rate to combat inflation that takes longer to fade.

Powell’s press conference could be summarised by his repeating of the phrase “we will stay the course until the job is done”, as he noted that despite the lower inflation prints over the past two months, “it will take substantially more evidence to gain confidence that inflation remains on a sustained downward path”. He acknowledged a likely slowing in the pace of future rate hikes depending on the incoming data and did not rule out a 25bps hike at the next meeting, although he still believes there is a “ways to go” before reaching the terminal rate. He expects a slow decline in inflation as the labour market “remains extremely tight”, and although goods price inflation and housing are declining fast, he emphasised that non-housing-related services prices representing 55% of core CPI are still increasing rapidly, driven mainly by high rates of wage growth.

In summary, it is clear the Fed remains concerned by inflation that has proven to be higher and more persistent than it ever expected and is relying less on its forecasts to set policy, and more on economic outcomes. The market however, prefers to fight the Fed on its rate projections and continues to price a peak fed funds rate of 4.88% in May next year, with a decline to under 4.5% by December.

UK inflation finally peaks

After overshooting expectations in 11 of the past 13 months, UK inflation finally eased by more than expected from October’s 41-year high of 11.1% to 10.7% in November, with the core rate falling to 6.3% from 6.5%. The Consumer Price Index had jumped 2% in October, but November’s .4% rise was two tenths below expectations and the smallest monthly increase since January, signalling a turning point in the worst cost of living squeeze in decades. Prices for transport - which includes fuel and second-hand cars - made the largest downward contribution, which was partially offset by further steep price rises for food and alcohol in restaurants and hotels.

Goods price inflation declined from 14.8% to 14% with the year over year decline in second-hand car prices accelerating, and although fuel prices were little changed over the month, base effects led to a drop in the year over year increase from 22.2% to 17.2%. Inflation in goods will drop rapidly in future months but services inflation is stickier and was unchanged on the month at 6.3%, almost matching November’s 6.1% growth rate of average UK earnings. The Bank of England will most likely deliver a 50bps hike today, but the MPC seems deeply divided over the appropriate size of hike and the extent of further tightening needed to bring inflation closer to its 2% target. The votes among the nine-member committee could include a four-way split between zero and each 25bps increment to 75bps.

ECB to prioritise inflation battle

The ECB will also announce a 50bps hike today and a roadmap to reducing its balance sheet next year, despite concerns over slowing economic activity, with the market focusing on its updated economic projections and Lagarde’s press conference.

Data yesterday showed the recent resilience of industrial production in the face of escalating energy costs has been impressive but may be coming to an end, with a 2% decline in October following a .8% increase in September. The decline was broad-based with most member states reporting drops, although an upward revision to previous data kept the year over year increase of 3.4% slightly ahead of expectations.

Markets

Sellers of overnight options would have been richly rewarded, with few moves in fixed income, rates or equities that might have justified the elevated premiums.

Fixed income

Steeper European curves but little change in treasuries.ECB to prioritise inflation battle

The ECB will also announce a 50bps hike today and a roadmap to reducing its balance sheet next year, despite concerns over slowing economic activity, with the market focusing on its updated economic projections and Lagarde’s press conference.

Data yesterday showed the recent resilience of industrial production in the face of escalating energy costs has been impressive but may be coming to an end, with a 2% decline in October following a .8% increase in September. The decline was broad-based with most member states reporting drops, although an upward revision to previous data kept the year over year increase of 3.4% slightly ahead of expectations.

Markets

Sellers of overnight options would have been richly rewarded, with few moves in fixed income, rates or equities that might have justified the elevated premiums.

Fixed income

Steeper European curves but little change in treasuries.

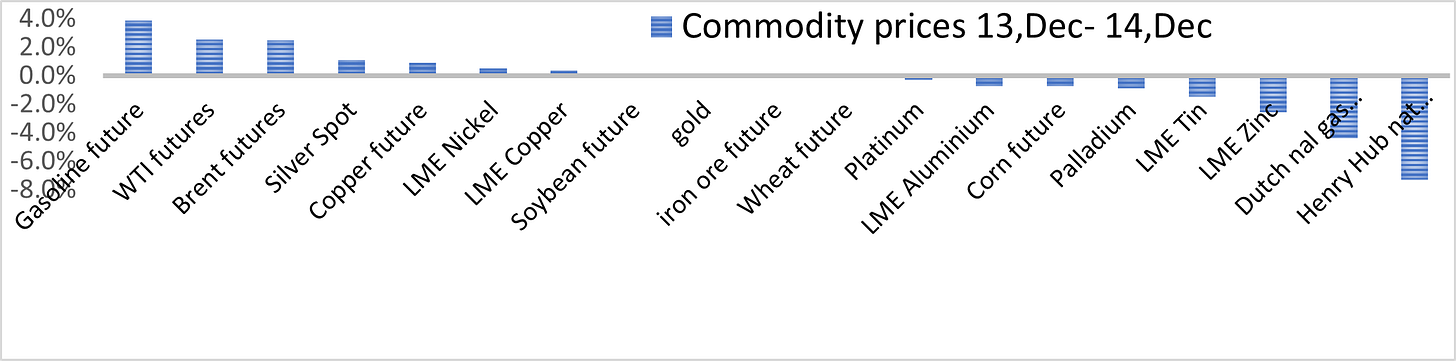

Commodities

Lower European natural gas futures on forecasts of less frigid conditions.

Equities

Hopes of a significant dovish pivot were dashed.

Today’s events

Japan trade balance November

UK BoE MPC meeting

ECB Governing Council meeting, EU new car registrations November, France business confidence December

US retail sales November, Empire manufacturing index December, Philly Fed Business Outlook December, industrial and manufacturing production November, weekly initial and continuing claims.